Back in January, we asked some of the most prominent players in the beauty investment and M&A business to make predictions about what was to come in 2023.

Generally, their predictions were pretty spot-on. They gave us macro predictions like “Beauty M&A will start slow with the potential for a strong year,” and “Beauty investors will remain skittish.” They also made more tactical predictions like “Mass will be the new frontier for prestige beauty in the US,” “Asian buyers will be a real force in M&A,” and “Omnichannel will drive growth and capital needs.”

In the first half of 2023, we’ve seen all of these trends play a meaningful role in influencing what has been a pretty lackluster six months for beauty deal activity.

The back half of the year, however, is showing signs of being a lot more interesting—primarily because of things no one in their right mind could have predicted back in January. Who would have been contrarian enough to predict that niche fragrance, historically an absolute snooze of a category from a deal-making perspective, would become one of the hottest categories by midyear? What rational person was thinking that the IPO of a technology-first, DTC-only beauty company with brands called Il Makiage and Spoiled Child would see a 35% debut pop from its IPO price and be the beacon of hope the equity markets have been waiting for after a virtual IPO drought in the first half. What’s more, who’d have guessed that, despite persistent inflation and rate hikes, the recession we’ve all been waiting on for the last 12 months would, once again, be postponed, all while unemployment remains at a near-record low of 3.6% in the US. Thus far, 2023 has kept the beauty capital markets on their toes and, if the last few months are any indication, things could get very interesting in the back half.

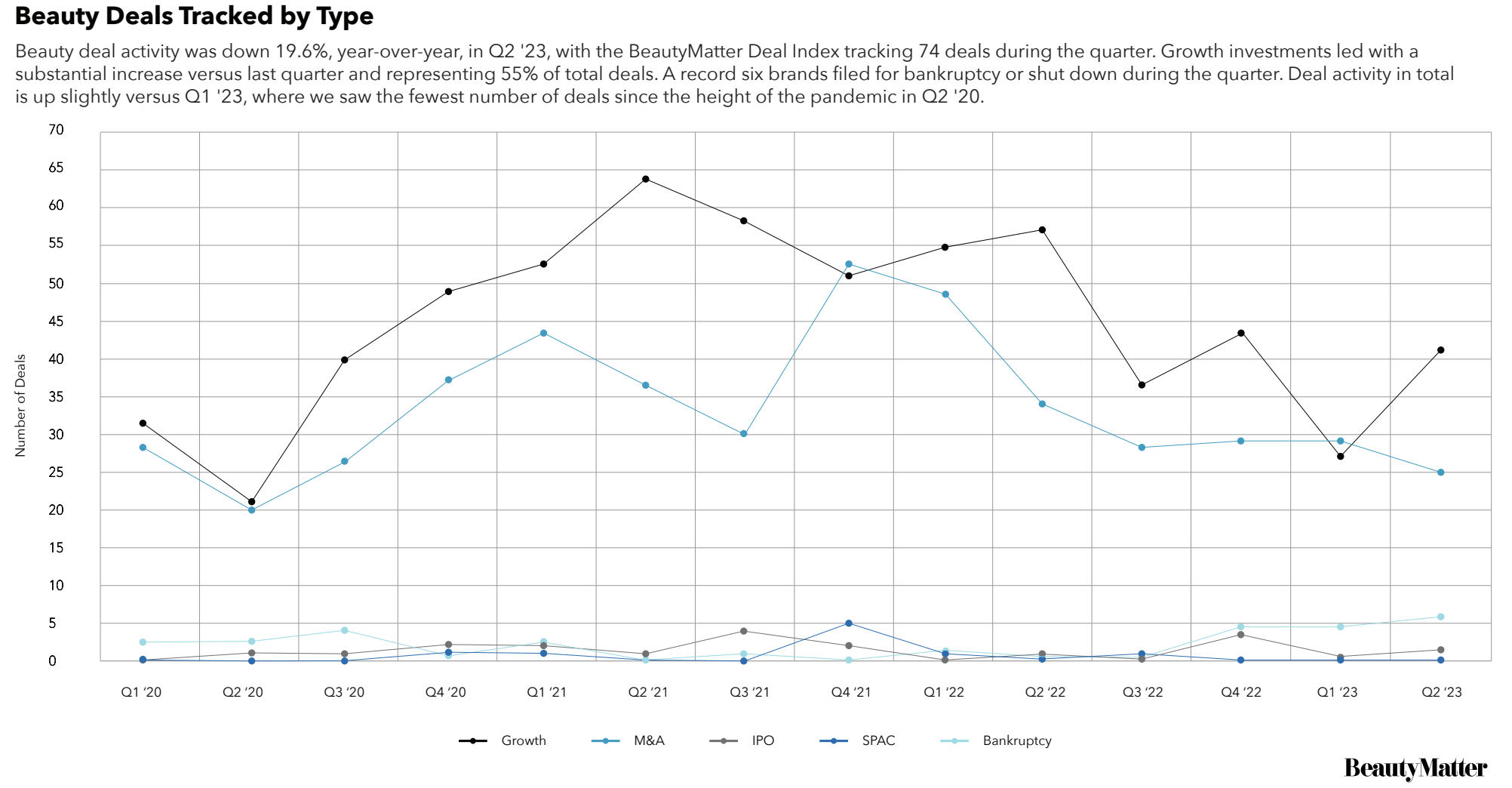

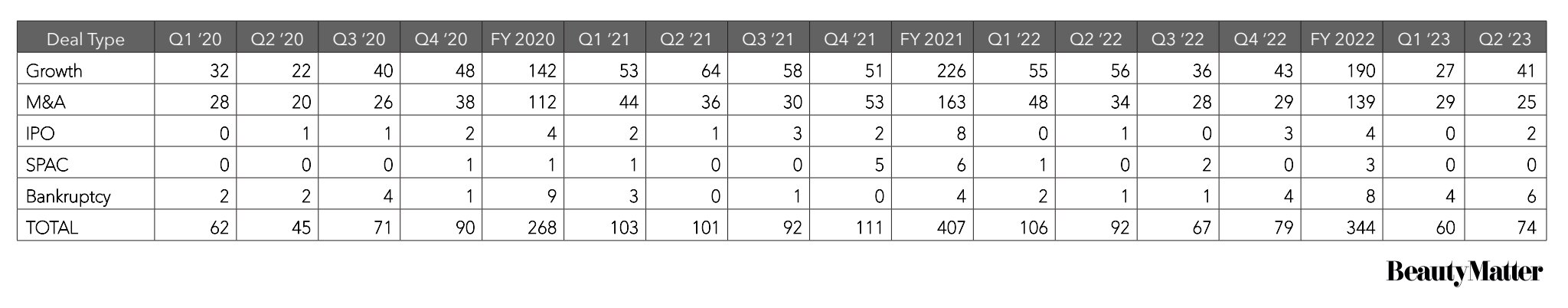

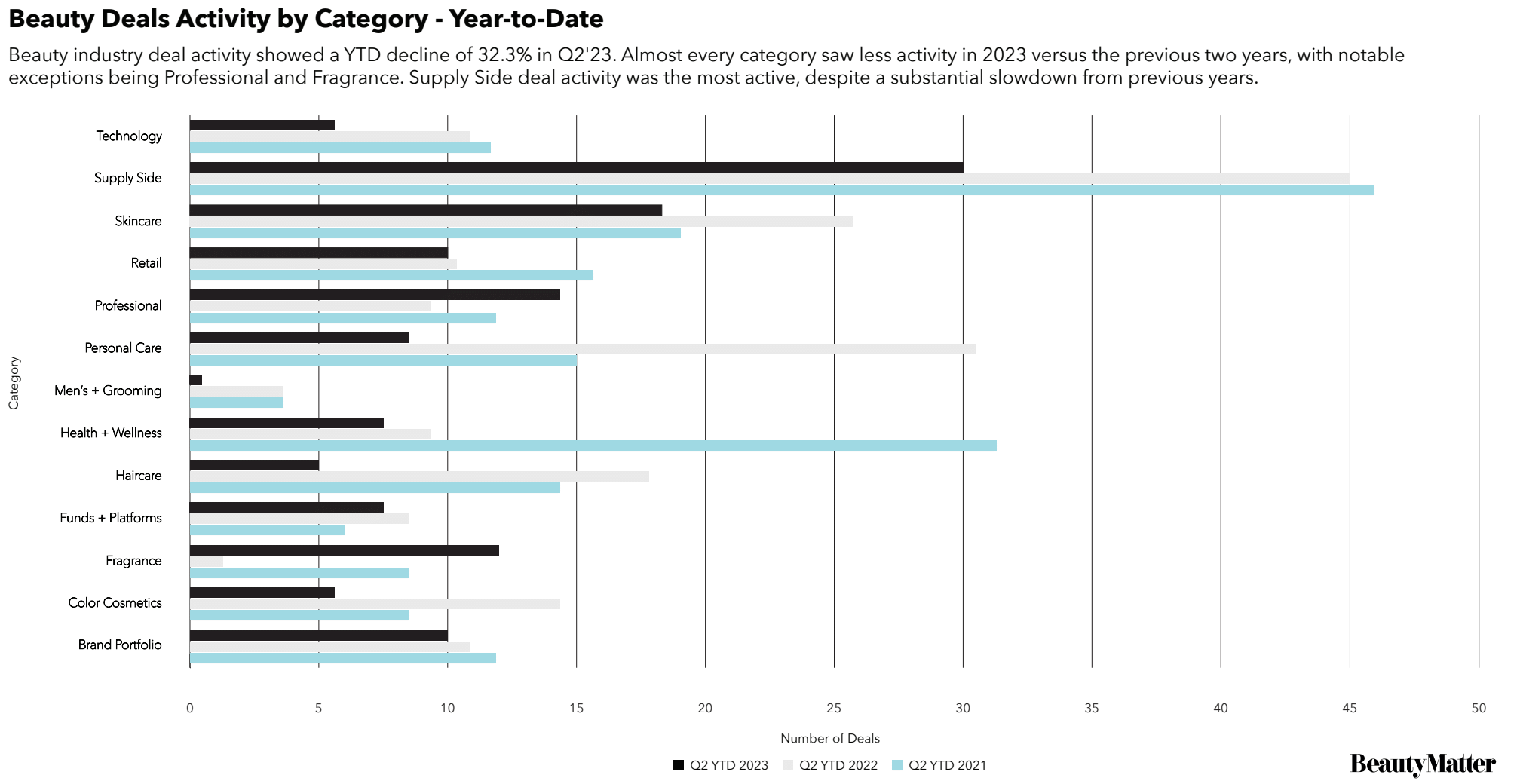

Before we can speculate where we’re headed, it’s important to understand where we’ve been. During Q1 2023, beauty deal activity was anemic, with the BeautyMatter Deal Index tracking the fewest number of deals since the height of the pandemic. Q2 2023, however, saw a 23.3% uptick in deal activity versus Q1, largely driven by increased activity in growth deals, which represented 55% of the total 74 deals we tracked during the quarter. Overall, the first half of 2023 was down 32.3% versus the first half of 2022.

Although deal activity was down across the board, the biggest brunt of the decline in deals in the first half was seen in the earlier-stage, start-up side of the market.

According to Crunchbase, just over $300 million in venture funding went into beauty during the first half, which represents a 50% decline from the same period last year and puts 2023 on track to deliver the lowest annual tally for beauty-related funding in years. The first half also saw 10 companies announce they were filing for bankruptcy or shutting down, including six during the second quarter. This was a 233% increase from the first half of last year, when we saw only three bankruptcy/shutdown announcements. Among those shutdowns, former Birchbox owner, FemTec Health, announced it was winding down, P&G shuttered its precision skincare brand Opté, and skincare start-up Wldkat announced it was closing.

During the first half of 2023, deal activity was down across almost every category tracked by the BeautyMatter Deal Index with two notable exceptions—both the fragrance and the professional categories showed growth. Deal activity in the fragrance category was one of the biggest surprises in the first half. Q2 2023 saw nine fragrance deals and Q1 2023 saw three deals, for a total of 12 deals in the first half. This exceeded the nine deals we saw in all of 2022 and ties the 12 we saw in all of 2021. All indications are pointing to a record year for the category. Standout fragrance transactions include Kering’s purchase of Creed, an investment in Juliette Has A Gun by Cathay Capital and Weinberg Capital Partners, Parfums de Marly and Initio Parfums Privés’ acquisition by Advent International, Sandbridge Capital’s Series A investment in Henry Rose, and Fable’s investment in Perfumer H. On the professional side, we saw 14 deals in the first half of 2023, up from the nine we saw in the first half of 2022 and the 12 we saw in the first half of 2021. Standout professional transactions include Kevin Murphy’s acquisition of Showpony, the growth investment by Prelude Growth Partners in Skin Pharm, Index Ventures’ investment in GetHarley, and PeakSpan Capital’s investment in Salonkee. The usually active supply side category remained busy despite being down 33.3% YTD, with 10 deals logged during Q2 2023 and 30 total in the first half. Deals were largely focused on acquiring targets with technology and expertise related to sustainability and biotech.

What to Expect in the Back Half of 2023

If there’s anything that’s certain about 2023 so far, it’s that investors and dealmakers will need to get comfortable with uncertainty to forge ahead in the back half of the year. Despite this fact, there are plenty of reasons for dealmakers to start to feel a bit more optimistic than they have been for the last six months. We’ve gathered some insights from three beauty dealmakers that support this optimism.

Kelly McPhilliamy, Managing Director and Health and Beauty Lead at investment bank Harris Williams:

The equity markets rebounded in June on more positive data and momentum in the US economy, and we believe a stronger market environment, coupled with supply and demand factors in beauty, will support increased deal activity in late 2023. Strategics depend on M&A as a cornerstone of their growth strategy, and the pipeline of potential deals is growing—especially as financial investors require exits to secure returns.

Ultimately, beauty M&A follows the consumer. Key consumer trends, including continued prioritization of beauty products amid economic uncertainty, a growing desire to seek joy in affordable indulgences, and a shift in how Gen Z engages with beauty products, will continue to drive growth and M&A opportunities in the beauty sector.

Lauren Leibrandt, Director at investment bank R.W. Baird & Co.:(重点)

New deal launches have picked up over the past few months, with more sellers entering the market and seeking to capitalize on the limited supply of targets. At the same time, the gap between buyer and seller valuation expectations has narrowed, facilitating a more constructive environment to reach an agreement on deal price and terms.

Both financial sponsors and strategics are in deployment mode, given ample dry powder and cash on the balance sheet. The number of reduced private equity exits in the recent past and fundraising pressures will encourage more sell-side M&A activity in the near term.

The equity markets have also picked up at the end of Q2 2023 and heading into Q3 after essentially being shut for the last 18 months. It’s an encouraging sign that some of the recent consumer IPOs have been so well received.

Luc-Henry Rouselle, Managing Director at investment bank DC Advisory:

Brands that have been performing well and achieving scale may be considering their options. They should be nimble and prepare to be ready for a process when conditions improve. When the window opens, we expect a wave of deferred activity will come to market.

Despite the recent slowdown in the number of transactions, strategics and private equity firms remain bullish on the long-term fundamentals of the beauty and personal care industries and will continue to look at opportunities seriously as they arise.

Beyond brands, we believe that beauty services, including medical spas, contract manufacturing, and technology will also continue to attract a lot of interest.

丨信息来源:https://beautymatter.com/articles/q2-2023-beauty-deals

ufabet

มีเกมให้เลือกเล่นมากมาย: เกมเดิมพันหลากหลาย ครบทุกค่ายดัง

ufabet

มีเกมให้เลือกเล่นมากมาย: เกมเดิมพันหลากหลาย ครบทุกค่ายดัง